As an activity in Language Arts, my class read the novel The Westing Game. In The Westing Game, one of the characters invests in the stock market. Turtle Wexler invested $20,000 in the market and monitored its progress throughout the book. Because of this, my class decided to have a stock market simulation to learn about stocks and investing.

As an activity in Language Arts, my class read the novel The Westing Game. In The Westing Game, one of the characters invests in the stock market. Turtle Wexler invested $20,000 in the market and monitored its progress throughout the book. Because of this, my class decided to have a stock market simulation to learn about stocks and investing.

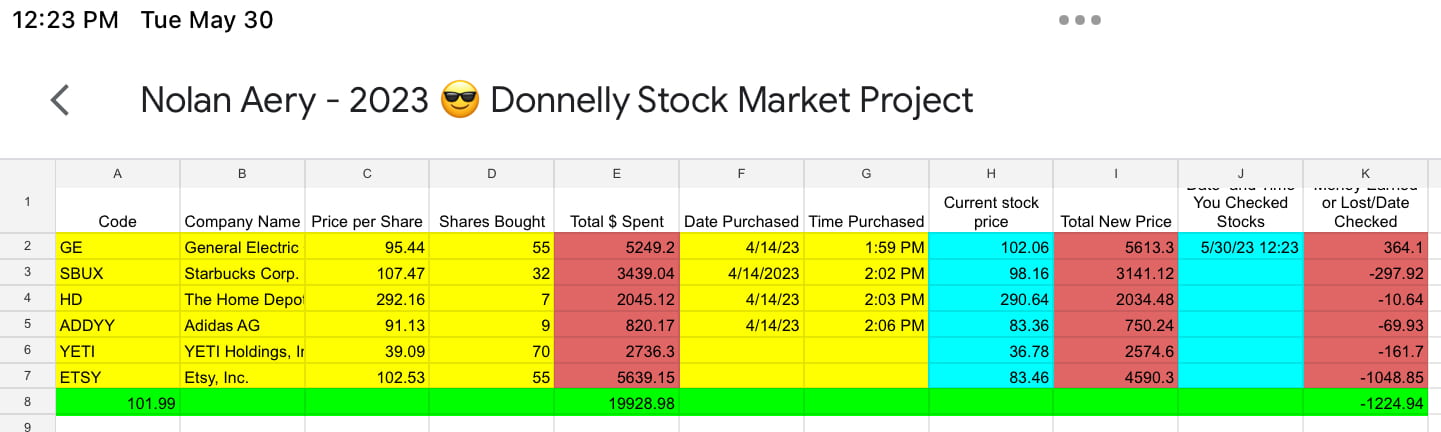

We kept track of our earnings on Google Sheets. We could spend up to $20,000 and could invest it in up to six stocks. For this particular simulation, we could only use New York Stock Exchange to choose our stocks. After the choosing of stocks, our class updated our earnings for about a month. At the end of the month, we discovered who won and lost the most money in the stock market simulation!

I decided to invest in six different stocks: The Home Depot, Yeti, Starbucks, General Electric, Adidas, and Etsy. I bought over 50 shares in both General Electric and Etsy, and over 70 shares in Yeti. In the first two weeks, General Electric skyrocketed, while most of my other stocks did not change much. My earnings peaked at $400, and then gradually lost money until I was in the negatives. Etsy tanked, dropping an entire fourteen dollars, and the rest of my stocks continued to decline. This trend stayed the same until the final counting, where I found out my final gain or loss.

At the end of the month, I had lost 1224.94 dollars. I lost over half of my money on Etsy, which never recovered from its huge drop. General Electric was my best investment; I made over 300 dollars off of it. I did not win biggest loser or biggest winner, but I still had fun monitoring my stocks.

I am very glad I didn’t invest real money into the stock market, for I would have lost a fortune! During my stock simulation, I learned how precarious the stock market is, and how it has major drops and gains. Now I know how to invest in the market and what to avoid while choosing stocks. I will continue to monitor my fake stocks over the summer, and have enjoyed partaking in this fun simulation.